Houston remains one of the most economically practical cities for newcomers, families, and professionals seeking balance between affordability and opportunity. As 2025 begins, many are evaluating monthly expenses, rent averages, and daily costs before making housing or relocation decisions.

The city continues to offer competitive pricing on rent, groceries, healthcare, and public services compared to both Texas and U.S. averages. Those exploring a move to Houston can expect moderate utility bills, a wide range of rental prices, and access to public transportation at one of the lowest costs among major U.S. cities.

The following analysis outlines the most recent data on cost of living in Houston. All price estimates, expense categories, and comparisons reflect current conditions as reported in early 2025, helping readers create informed financial plans for the year ahead.

Methodology

The data presented in this article is based on comprehensive cost-of-living reports gathered through two primary sources: Numbeo and RentCafe.

Numbeo provided detailed breakdowns for key expense categories such as restaurant pricing, grocery items, rent per square meter, public transportation fares, utility charges, and average net salaries.

These figures are derived from user-contributed entries and adjusted using statistical modeling to ensure accuracy. Each category is based on hundreds of data points submitted over the past twelve months. Information reflects typical consumer habits in Houston and is updated regularly to reflect ongoing shifts in market conditions.

RentCafe served as the foundation for rental market trends and housing comparisons. The platform collects proprietary pricing data across various neighborhoods using Yardi Matrix, a real estate research tool focused on multifamily housing trends.

Where RentCafe proprietary data is unavailable, supplemental pricing is sourced through the Cost of Living Index published by the Council for Community and Economic Research (C2ER). Rental costs are verified against current listings and regional medians and include variables for unit size and location.

Healthcare, transportation, and income metrics incorporate figures from the U.S. Census Bureau and city transportation agencies, while qualitative insights into affordability, neighborhood trends, and living conditions were sourced from localized consumer reports and market analysis posted in 2025.

Cost of Living at a Glance

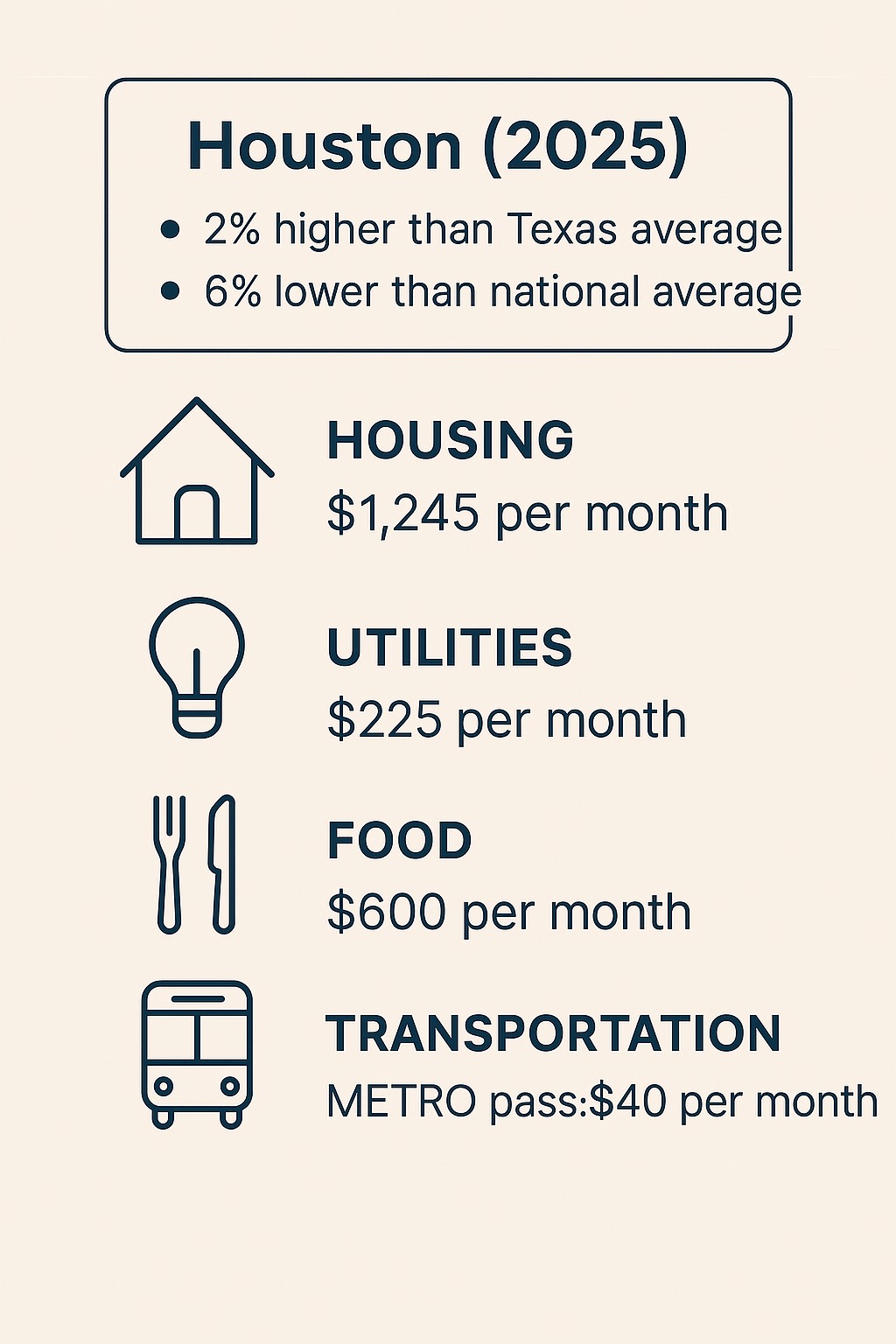

Houston closes the gap between affordability and access better than most large U.S. cities. In 2025, the city stays 2% higher than the Texas average but still 6% below national levels, offering cost savings in multiple areas without limiting essential services or livability.

Housing prices define the biggest gap. Rent in Houston averages 17% less than the national median, giving it a lead in urban affordability. One-bedroom units start at $1,245 per month, with city-center options rising to $1,661. The lower cost of property ownership also positions Houston ahead of markets like Dallas and Austin.

Utilities sit at a stable midpoint. Electricity, water, and trash services land between $198 to $300 monthly, with summer months nudging costs higher due to AC use. Internet packages, typically priced between $50 to $100, are widely available without heavy installation fees.

Groceries fall right in line with national norms, but not higher. Local produce, meats, and essentials stay affordable due to Houston’s extensive network of discount grocers and ethnic markets. One adult can expect to spend $500 to $700 monthly, depending on diet and frequency of home cooking.

Healthcare continues to be one of Houston’s financial strengths. Costs for basic services are 5% below the U.S. average, allowing more flexibility for those with private or employer-based coverage. Regular dental visits, urgent care, and check-ups fall into accessible ranges for most income levels.

Transportation rounds out the cost relief. Owning a car may cost $500 to $700 per month, but public transit stays extremely low. The METRO monthly pass remains fixed at $40, and a single ride costs $1.25.

Gas prices average $0.77 per liter, further supporting vehicle use without financial pressure.

Goods and services (clothing, personal care, general items) tick slightly above average by 1%, which barely impacts monthly budgets. Local alternatives and regular discount chains keep this manageable.

Houston’s full financial picture rewards residents who plan smart. Each major spending category either aligns with or beats national standards. Combined with strong wage averages and a healthy rental market, the city maintains its place among the most economically manageable metros in the country.

Monthly Housing Costs in Houston

Housing drives most budget decisions. In 2025, Houston continues to offer wide flexibility, with rental prices suited for singles, couples, and families. Rent trends remain steady, although neighborhood and apartment size create noticeable gaps.

Compared to the national housing market, Houston holds a 17% advantage, giving residents more space for less money.

Average Rent by Apartment Size

| Apartment Type | Monthly Rent Range | Notes |

|---|---|---|

| 1-Bedroom (Downtown) | $1,250 – $2,100 | Premium pricing tied to location and views |

| 1-Bedroom (Suburban) | $1,000 – $1,700 | Greater value in areas like Mid West |

| 3-Bedroom (Downtown) | $2,400 – $4,100 | Common in Midtown, The Heights |

| 3-Bedroom (Suburban) | $2,000 – $3,500 | Spacious layouts with lower per-foot cost |

Key Insight

Downtown apartments cost significantly more due to proximity to work hubs, nightlife, and school zones. However, neighborhoods like Greater Inwood or Sugar Land allow renters to cut hundreds per month without giving up access to shopping, transit, or recreation.

Cost Comparison: Rent vs. Ownership

| Expense Type | Monthly Cost (Est.) | Highlights |

|---|---|---|

| Rent (1-Bedroom) | $1,245 – $1,661 | Easier entry, flexible leases |

| Mortgage (20% down) | $1,600 – $2,400* | Depends on area and rate |

| Property Taxes | $400 – $800 | Higher in affluent suburbs |

| HOA (if applicable) | $200 – $450 | Varies by complex |

*Based on a 30-year fixed-rate loan, average home price of $340,000, and 6.48% interest

Median Home Prices by Area

Affordable Areas (Best for Buyers)

- Greater Inwood: $220,000

- Mid West: $234,500

- South Acres: $210,000

Mid-Range to High-End Zones

- Sugar Land: $335,000

- The Heights: $429,900

- Spring Branch East: $499,000

Utility Costs in a Typical Houston Household

Utility bills in Houston vary based on building age, insulation, appliance efficiency, and air conditioning use. Summer months push energy consumption higher, but many households manage to keep total monthly costs within a practical range.

For most apartments and homes, utility pricing stays aligned with national benchmarks.

Average Ranges

| Service Type | Monthly Cost Estimate | Notes |

|---|---|---|

| Electricity + Heating/Cooling | $133 – $398 | Higher in summer, lower in spring/fall |

| Water and Garbage | $40 – $80 | Often bundled into rent or HOA fees |

| Internet (60+ Mbps) | $50 – $100 | Cable or ADSL, usually uncapped |

| Mobile Phone Plan (10GB+) | $25 – $100 | Based on data cap, international calling |

For an average 85m² apartment, total utility costs range between $198 and $300, with electricity as the largest contributor.

Food and Grocery Prices in 2025

Food expenses in Houston reflect national averages, with flexibility based on shopping habits and location. Grocery bills can range between $500 and $700 per month for one adult.

Pricing stays consistent across major chains like H-E-B, Kroger, and Fiesta Mart, with additional savings available at ethnic markets and wholesale clubs.

| Item | Average Price (USD) |

|---|---|

| Milk (1 liter) | $0.91 |

| Eggs (12) | $3.66 |

| Bread (500g) | $3.03 |

| Chicken breast (1kg) | $12.26 |

| Beef (1kg) | $18.57 |

| Apples (1kg) | $4.51 |

| Bananas (1kg) | $1.37 |

| Tomatoes (1kg) | $2.70 |

| Water (1.5 liter bottle) | $2.22 |

| Domestic beer (0.5 liter) | $2.00 |

Those cooking at home consistently can save between $200 and $300 monthly compared to frequent dining out.

Restaurants range from quick service to upscale venues. An average meal at an inexpensive restaurant costs around $20, while a three-course dinner for two at a mid-range spot reaches about $80. Houston’s diverse food scene allows for flexibility at every budget level.

Transportation

Transportation is one of Houston’s most budget-friendly categories. METRO provides a fixed $40 monthly pass, and gasoline prices average $0.77 per liter, making daily driving cheaper than in most U.S. cities.

| Type of Transportation | Estimated Monthly Cost |

|---|---|

| Public Transit (METRO) | $40 |

| Car Ownership | $500 – $700 |

| Gasoline | $0.77/liter |

| Taxi/Uber per ride | $10 – $20 |

Healthcare Affordability and Access

Houston healthcare services cost about 5% less than the national average. Routine check-ups, dental cleanings, and emergency visits stay within moderate price ranges.

Large medical networks like Memorial Hermann, Houston Methodist, and HCA Healthcare serve the city with a wide range of in-network providers.

Residents using employer-sponsored plans often pay minimal out-of-pocket for regular care. Telehealth services, now common, also reduce costs and improve access.

Pharmacies throughout the city offer generics at competitive prices, supporting chronic care management without overburdening monthly budgets.

Other Everyday Expenses

Beyond rent, groceries, and transit, other categories vary by lifestyle. Families, students, and single professionals all face unique expenses that influence total monthly costs.

| Category | Average Cost (USD) |

|---|---|

| Gym Membership | $38.50 |

| Cinema Ticket | $15 |

| Childcare (Preschool) | $1,240 |

| International School (Annual) | $18,933 |

| Jeans (Levi’s 501 or similar) | $48.86 |

| Running Shoes (Nike) | $105.50 |

Free activities like hiking trails, art festivals, and Museum District events provide low-cost entertainment. Houston’s calendar of community events helps families enjoy weekends without overspending.

Affordable Neighborhoods to Watch

Choosing the right neighborhood plays a major role in controlling monthly costs. Several areas offer strong value without giving up safety, access, or amenities.

Notable Areas by Value

| Neighborhood | Median Home Price | Highlights |

|---|---|---|

| Greater Inwood | $220,000 | Quiet, green, suburban atmosphere |

| Mid West | $234,500 | Diversity, shopping, central access |

| Sugar Land | $335,000 | Family-focused, strong schools |

| The Heights | $429,900 | Historic charm, walkable streets |

Suburban areas reduce rent and purchase costs while often adding perks like better schools, more space, and safer streets.

Conclusion

Houston gives you more control over your money than most large cities. Prices stay consistent. Housing remains affordable in many areas. Daily expenses never spiral out of reach if you plan with focus. That gives you a real chance to live well without overspending.

If you earn an average income and want space, basic comfort, and reliable services, Houston works. You can find one-bedroom rent near $1,250. You can spend under $200 on utilities. You can manage groceries for about $600 each month if you cook at home. None of that depends on luck. It depends on smart choices.

Use METRO if your job or school is close to a line. Buy groceries at ethnic markets where prices are lower. Live in Greater Inwood, Mid West, or Sugar Land if you need lower home prices without losing safety or convenience. Each one of those decisions saves money without forcing sacrifice.

If you plan to buy property, wait for the price drop expected later in the year. That gives you a better deal and a more secure mortgage. If you rent, compare offers and look for move-in deals. Even small discounts will make a difference across twelve months.

You do not need to guess your budget. Houston lays it out. Rent, food, transport, and bills each follow a pattern. That makes it easier to predict how your monthly expenses will line up with your income.